Revolutionizing Personal Finance: Mid Oregon Credit Union’s Digital Banking Platform

Are you tired of navigating through a maze of banking apps and websites to manage your finances? The era of fragmented financial management is over. Mid Oregon Credit Union has introduced a cutting-edge digital banking platform designed to simplify and unify your financial life. This platform offers a consolidated view of all your accounts, from checking and savings to credit cards, all in one place. With just a tap, you can monitor balances, transfer funds, and pay bills without logging into multiple systems. It’s not science fiction; it’s the reality of modern digital banking.

Imagine a seamless experience where your financial data is centralized, giving you complete control over your money. This is precisely what Mid Oregon Credit Union’s new digital banking platform delivers. Kevin Cole, Executive VP/CFO, emphasizes that the platform is engineered to enhance member service, offering an intuitive and secure experience across all devices. The platform caters to the evolving needs of today’s tech-savvy users, providing features that are both practical and innovative.

| Feature | Description |

|---|---|

| Unified Account View | Consolidated display of all accounts (checking, savings, credit cards, etc.) in one place. |

| Mobile Banking | Access accounts and perform transactions via smartphone or tablet. |

| eBillPay | Pay bills electronically through the platform. |

| eStatements | Receive account statements electronically instead of via mail. |

| Card Activation | Activate new debit and credit cards instantly through the platform. |

| Mobile Wallet Integration | Add debit and credit cards to mobile wallets like Apple Pay and Samsung Pay. |

| Personalized Logins | Set up individual logins for multiple users on the same account. |

| Account Transfers | Transfer funds between accounts effortlessly. |

| Alerts | Receive notifications about account activity, such as low balances or unusual transactions. |

| Enhanced Security | Utilizes advanced security measures to protect account information. |

| Overdraft Protection | Prevent overdraft fees by transferring funds from another account. |

| Direct Deposit | Set up direct deposit for paychecks or other recurring payments. |

| Wire Transfers | Send and receive wire transfers securely. |

| Quicken/QuickBooks Integration | Sync account data with Quicken or QuickBooks for easier financial management. |

| Automated Payments | Schedule recurring payments from your checking account. |

| BillPay Scheduling | Schedule monthly bill payments through the platform's bill pay feature. |

| Flexibility in Transfers | Greater flexibility in transferring money between accounts. |

| Streamlined Account Viewing | A more streamlined way to view all your accounts. |

For more information, visit Mid Oregon Credit Union’s official website.

The adoption of this groundbreaking platform has been nothing short of remarkable. Within its first week, over 75 percent of online banking users embraced the new system, highlighting its user-friendly design and clear advantages. This rapid transition reflects the growing demand for convenient and secure digital banking solutions. The platform is not merely a tool for managing finances but a gateway to a smarter financial future. Whether you reside in Bend, Oregon, or any other location, the platform ensures enhanced security features to safeguard your financial data. It’s crucial to get started right and take full advantage of these advanced protections.

Mid Oregon Credit Union’s digital banking platform evolves continuously to simplify money management. Services are logically grouped, enabling users to save, borrow, budget, and plan their financial lives with just a few clicks. The platform adapts to your needs, whether you prefer the convenience of a desktop computer or the portability of a mobile device. Transferring funds between Mid Oregon accounts or external accounts is now faster and more efficient than ever. The process is designed to be intuitive and hassle-free, ensuring a smooth transition for existing users. And let’s not forget the easy and friendly service that Mid Oregon is renowned for.

The platform offers a comprehensive suite of credit union services, including overdraft protection, direct deposit, and wire transfers. To avoid convenience fees, consider setting up automated payments from your Mid Oregon checking account or another financial institution. This ensures timely bill payments without manual intervention. You can also schedule monthly bill payments using the platform's easy billpay feature, empowering you to manage your finances with precision.

- Cheryl Howard From Splash To A Beautiful Mind Ron Howards Wife

- Blue Cross Blue Shield Nm Your Guide To Plans Coverage

The platform provides numerous benefits, such as enhanced flexibility in transferring money between accounts, robust security measures to protect financial data, and a streamlined way to view all your accounts. It integrates seamlessly with Quicken and QuickBooks, offering a holistic view of your finances. Personalized logins for multiple account users are another standout feature, particularly useful for families or businesses requiring shared access. The platform also includes conveniences like paying and tracking bills online, performing account transfers, setting up alerts, and accessing electronic statements.

One of the most innovative features is the ability to activate new cards instantly using the platform’s card activation feature. This eliminates the need for phone calls or visits to branches, enabling immediate use of your new card. Additionally, you can add Mid Oregon debit and credit cards to mobile wallets like Apple Pay or Samsung Pay, enhancing convenience and security during transactions. The platform’s enhanced security measures include multi-factor authentication, encryption, and fraud monitoring, ensuring your financial information remains safe from cyber threats.

Mid Oregon Credit Union is committed to delivering the best possible banking experience. The new digital platform exemplifies this commitment, offering convenience, security, and user-friendliness. Users can access their accounts and perform transactions effortlessly, whether at home, work, or on the go. The platform provides free mobile banking, ebillpay, and estatements, enabling efficient financial management without incurring additional costs. These services include accessing accounts from anywhere with an internet connection, simplifying bill payments, and providing secure access to account statements.

Opening a new Mid Oregon checking account by May 23 offers a chance to win exciting prizes. This is an excellent opportunity to experience the platform’s benefits and potentially claim a reward. For assistance, visit any of Mid Oregon’s eight branches, call or text the local contact center. The friendly and knowledgeable staff are ready to help you navigate the platform and address any questions.

The platform’s recurring theme is the unified view of all accounts, which forms the foundation of a convenient and efficient digital banking experience. Mid Oregon’s commitment to staying at the forefront of digital banking technology ensures that users can expect regular updates and improvements. The platform’s intuitive organization makes it easy to find the services you need and manage your finances effectively. Transferring funds between Mid Oregon accounts, external accounts, or individuals is streamlined, and recurring transfers can be set up to automate savings or bill payments.

Mid Oregon Credit Union’s systems undergo periodic maintenance to ensure stability and security. For instance, digital banking and telephone teller services were unavailable between 9:00 pm PDT on Saturday, April 12, and 3:00 am PDT on Sunday, April 13, for approximately six hours. Such scheduled maintenance is essential for maintaining platform reliability. Users are encouraged to activate their cards easily within the digital banking platform by following clear instructions. Protecting login credentials is paramount, and Mid Oregon provides resources and guidance to ensure account safety, including using strong passwords, avoiding phishing scams, and keeping software updated.

Mid Oregon Credit Union’s digital banking platform aligns with broader trends in the financial industry, emphasizing convenience, security, and innovation. As financial institutions worldwide adopt similar technologies, the platform positions Mid Oregon as a leader in digital banking. Celebrities and influencers in the fintech space, such as Dave Ramsey and Suze Orman, advocate for simplified financial management tools. Mid Oregon’s platform resonates with their message, empowering individuals to take control of their finances. The impact on society is profound, as more people gain access to tools that foster financial literacy and responsibility. By embracing this platform, users can achieve their financial goals with confidence and ease.

- Dutton Family Tree Yellowstone 1883 1923 Explained

- Briggs Funeral Home Candor Nc Recent Obituaries Services

Mid Oregon Credit Union

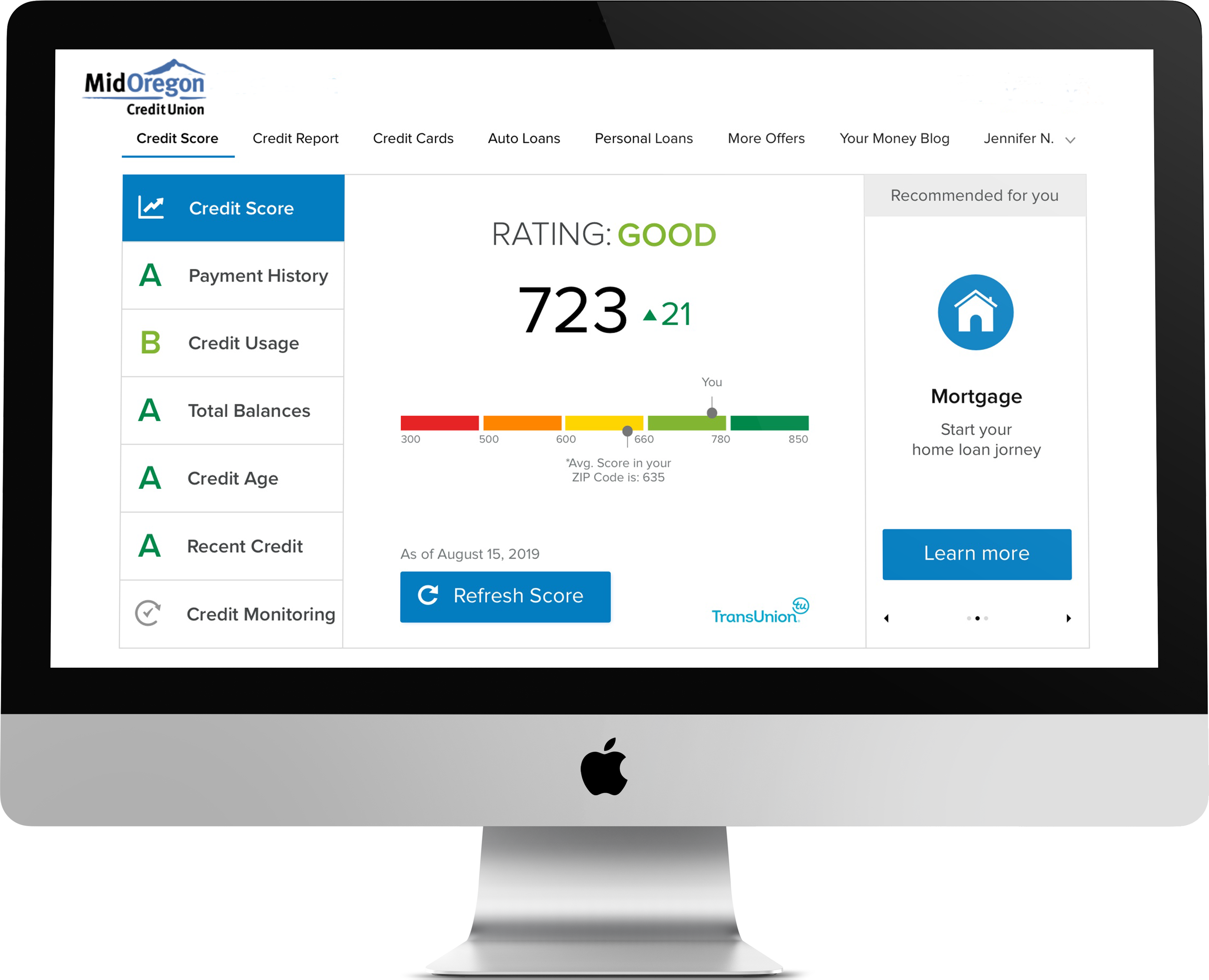

Credit Savvy Mid Oregon Credit Union

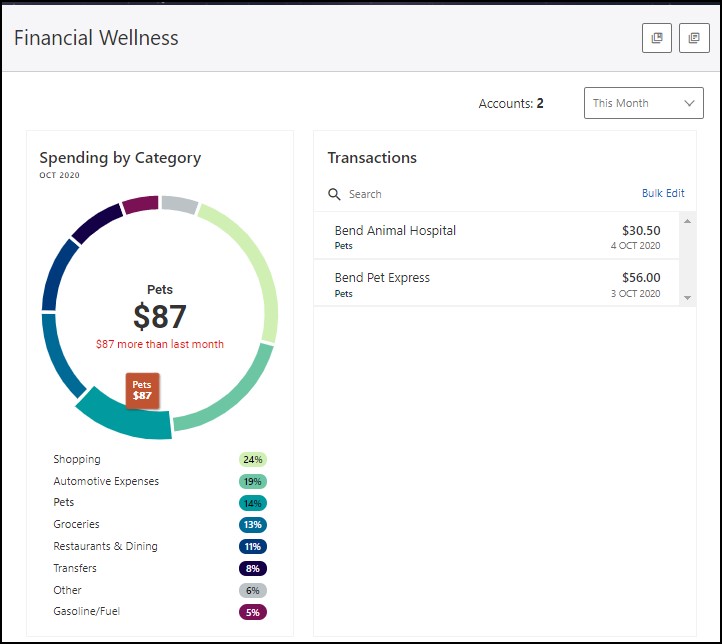

Mid Oregon Financial Wellness Widget